Company News

Kingsbarn Realty Capital Announces a $200 Million Revolving Credit Facility to Further Expand Its Footprint Across the United States

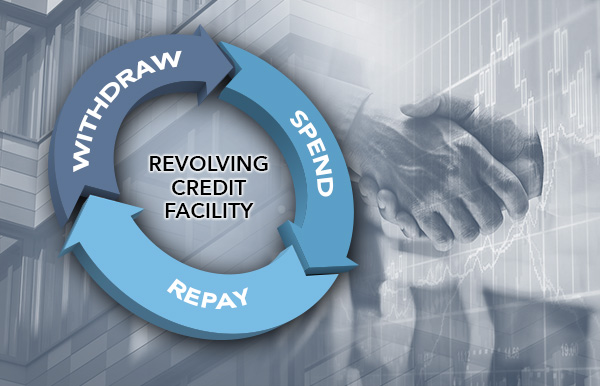

Las Vegas, Nevada, February 9, 2021 – Kingsbarn Realty Capital LLC ("Kingsbarn" or the "Company") today announced that it has closed a three-year, asset-backed, revolving credit facility (“Revolver”) of $200 million to expand the Company’s acquisition capital. The new Revolver will be used exclusively to acquire new assets for the company’s Delaware Statutory Trust (“DST”) platform along with the Company’s registered Managed-Direct Ownership® (“MDO”) platform.

Jeff Pori, CEO of Kingsbarn, shared, “The DST market has grown an average of 17.5% a year since 2017 to over $3 billion of equity invested in 2020 (1). This steady growth demonstrates the desire of individual investors to partner with established DST sponsors like Kingsbarn who can provide asset diversity to those investors at multiple investment levels. This new acquisition line is critical to supporting our expanding DST sponsoring business which will allow us to acquire premium properties that meet the investment parameters or our 1031-exchange-centric investor base.”

Kingsbarn elected to partner with a private lender to create a unique Revolver that would achieve its desire of flexible capital to deploy as market opportunities present themselves. Mr. Pori stated, “This Revolver will position Kingsbarn for significant growth following eight straight years of steady expansion. It will also expand the Company’s position in the DST market by providing the opportunity to offer multiple investment opportunities concurrently and to expand our DST market presence throughout the nation.”

In electing to partner with the private lending market versus a more traditional lender, Mr. Pori found the flexible structure offered by the private lending market to be unique. These private lenders did not come to Kingsbarn with a “take-it-or-leave-it offering” but rather, they constructed a Revolver that matched Kingsbarn’s approach to the DST market, finding ways to deploy capital more efficiently and effectively which immediately benefits Kingsbarn and ultimately its investors.

The Revolver officially closed on December 17, 2020, allowing Kingsbarn to acquire six DST properties over the five weeks since its close.

About Kingsbarn Realty Capital

Kingsbarn Realty Capital is a real estate, private equity, and development firm based in Las Vegas, Nevada. Kingsbarn structures its real estate investment opportunities for both fractional 1031 investors as well as customized portfolio solutions for large-scale investors. Kingsbarn’s management team has wide-ranging experience developing, managing, and sponsoring a diversified portfolio of stabilized, income-driven properties. Kingsbarn has acquired and currently operates over $500 million of commercial real estate throughout the United States. In 2020, Kingsbarn Capital and Development was founded as the company’s development arm to expand the product offerings to include ground-up development of real estate assets and to fund operating companies who require real estate solutions across the United States.

(1) Equity statistics provided by Mountain Dell Consulting, LLC

No Offer

This is not an offer. An offer will only be made pursuant to the delivery of the required offering documents, including the private placement memorandum, as supplemented or amended (the “Memorandum”) and only in states in which the securities offered pursuant to the Memorandum are registered or exempt from registration requirements, and only by broker-dealers authorized to do so. This information discusses general information about the portfolio and is not a guarantee, prediction or projection of future performance. Diversification does not protect against loss or guarantee return. There are risks associated with investing in real estate assets, such as inflation, interest rates, real estate tax rates, changes in the general economic climate, local conditions such as population trends and neighborhood values, and supply and demand for similar property types. Investing in DSTs and 1031 exchanges involves significant tax consequences. Please refer to the Memorandum for detailed information about the offering and its associated risks and implications.

Forward-Looking Statements

This press release may contain forward-looking statements identified by the use of words such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this release. Kingsbarn assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events or circumstances.